Mutual Funds have time and again proved to be one of the best investment vehicle in India. The performance of mutual fund is based on the stock market trends and as we know ever since the launch of BSE and NSE the indices have always outperformed over the years. It has created a good amount of wealth for long-term investors.

I have been a Mutual Fund Investor since the age of 19 when I landed my first job because it’s always good to start investing early for compounding the have a magical effect on your investment, compounding is a different topic so let’s keep that for later. When I started Investing back then in 2016 most of the mutual fund platforms like Funds India, ET Mutual Fund and Funds Bazar were resellers or distributors of mutual funds such mutual fund schemes are known as regular mutual funds. In 2013 SEBI had introduced two investment plans for mutual funds, Regular and Direct plan, It made mandatory for all mutual fund houses to launch these schemes immediately. But people still preferred regular plans because all the investments could be tracked on a single platform provided by the distributor whereas investing in direct mutual funds would require you to open separate accounts with each AMC you invest in. The first plan sounds hassle-free compared to the latter, unfortunately, most people aren’t aware of the charges paid to the distributor as commission which gets siphoned off from the investment gains.

The only major difference between direct and regular plan is the expense ratio. Regular plans are sold by distributors hence they have a higher expense ratio, on the other hand, the expense ratio on the direct plan is lower, therefore, it can generate higher returns on your investment in the long run since the middle man is eliminated. So moving to a direct plan certainly makes sense. In this article, I have penned down a method to switch from a regular to a direct plan using Paytm Money, most people aren’t aware of how to switch to a direct plan so this guide will explain everything you need to know in order to get this done.

Paytm Money offers a wide range of financial services at very affordable rates and when it comes to mutual funds the company offers a plethora of direct mutual fund schemes with 0% commission. All your investments can be tracked and monitored on the Paytm Money mobile app and you are not required to register with each fund house when you invest in multiple funds.

Before you switch to a direct plan I’d like to point out few things that you need to keep in mind.

1) Switching to a direct plan is treated as redemption so your gains are taxable under STCG and LTCG.

2) The switch will also reset the net asset value to the prevailing net asset value of the direct plan.

3)You might also be charged an exit load upon redemption, if applicable.

How to convert regular mutual funds to direct mutual funds?

So the first step you need to take is to download the Paytm Money app on your phone. A KYC-compliant account will need to be created on Paytm.

After you have logged in find the banner that says Switch from Regular to Direct Mutual Funds. You will be taken to the next page where you need to read and select proceed.

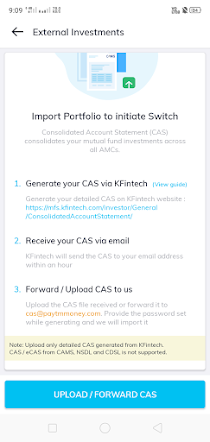

The process involves 4 steps:

Generate your CAS Statement via KFintech

Receive your CAS in your email inbox

Upload your CAS on the Paytm Money app

Select the funds you want to switch

Download your CAS Statement from KFintech MFS Investor. The website will be displayed on the screen.

- Statement: Detailed

- Period: Specific Period

- Start Date: Birth Date

- End Date: Present date ( the day on which you download the statement)

- Enter your email address and PAN card Number

- Create a password, this will be used to open your CAS file